Company Denies Sallies' Claim, Saying Oblates Knew Priest Was Likely to Molest

By Esteban Parra

News Journal

September 15, 2008

http://www.delawareonline.com/apps/pbcs.dll/article?AID=/20080915/NEWS01/809150345

An insurance company for the Oblates of St. Francis de Sales filed suit last week saying it does not have to pay a settlement reached between the Catholic order and a sexual abuse victim.

The suit filed by United States Fire Insurance Co. claims it doesn't have to pay because the order knew the priest was likely to abuse children.

|

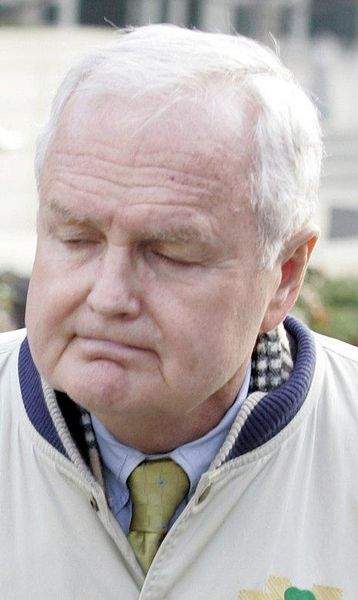

| The Rev. James W. O'Neill's abuse is at the center of an insurance lawsuit. |

It also says the Oblates knew the Rev. James W. O'Neill had a "propensity to sexually abuse minors" before the policy's inception on Feb.1, 1985.

O'Neill started sexually abusing Eric Edenin 1976, when he was principal of Salesianum School. O'Neill was never reported to police and Eden's parents said they were pressured to remain silent after they reported one incident of inappropriate sexual conduct.

"Because the alleged sexual abuse and injury of Eden during the U.S. Fire policy period was not fortuitous [an incident occurring by chance or accident], U.S. Fire has no obligation to indemnify the Oblates for any settlement sum paid to settle Eden's claims," the suit says.

Oblates attorney Mark Reardon would not comment because they have not seen the suit.

Salesianum, the Oblates and various Oblate officials reached settlement with Eden in March. Eden's attorney, Stephen J. Neuberger, said the Oblates paid his client the undisclosed settlement a few days after reaching the agreement.

"Insurance companies don't make money by paying claims," Neuberger said. "Insurance companies always try to deny claims. This is just a more public example of that."

Neuberger added that he believed the Oblates' insurance covers this.

"Sallies has good lawyers," he said. "I'm sure they did their homework way back when, even in the 1980s, and I'm sure that their insurance contract probably covers this."

A ruling in favor of the insurance company could mean the Oblates will have to reach into its own pockets if other such cases come up. Most liability policies contain an "intentional acts exclusion," saying if the harm was expected by the insured there is no coverage.

"It's really a question of whether or not the insurance company had a duty to defend, whether they agreed to defend, and more importantly, whether they had a duty to indemnify because this conduct falls under the intentional acts exclusion," said Martin A. Kotler, a Widener University School of Law professor. "Generally speaking, in a lot these cases that have come along, particularly if you are dealing with the sexual molestation of a minor, courts have tended to find that that is not covered."

As more sex-abuse cases are resolved, there could be more of these suits filed by insurance companies, Kotler said. And if the courts rule the way they have in the past, it is possible that the defendant will have to pay.

About 20 lawsuits have been filed in Superior Court naming the Oblates and the Catholic Diocese of Wilmington since the passage of the Delaware Child Victim's Act of 2007. Attorneys said they expect to file more suits.

Oblates and diocese officials declined to comment.

Contact Esteban Parra at 324-2299 or eparra@delawareonline.com.

Any original material on these pages is copyright © BishopAccountability.org 2004. Reproduce freely with attribution.