By Laurie Goodstein

New York Times

January 7, 2011

http://www.nytimes.com/2011/01/08/us/politics/08churches.html?_r=1&partner=rss&emc=rss

|

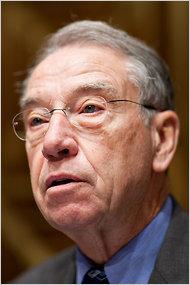

| Senator Charles E. Grassley led a three-year investigation. |

A three-year investigation into financial improprieties at six Christian ministries whose television preaching bankrolled leaders' lavish lifestyles has concluded with the formation of an independent commission to look into the lack of accountability by tax-exempt religious groups.

Senator Charles E. Grassley, an Iowa Republican and the ranking member of the Senate Finance Committee, issued a report saying that "self-correction" by churches and religious groups is preferable to legislative or regulatory solutions.

But his report found that only two of the six ministries cooperated with his investigation and volunteered to institute reforms. The others continued to hide behind tax laws that allow religious organizations to operate tax-free with little transparency or public accountability — a status that sets them apart from other nonprofit groups and charities that must file detailed annual reports of expenditures to the Internal Revenue Service.

"The challenge is to encourage good governance and best practices," Senator Grassley said in a statement, "and so preserve confidence in the tax-exempt sector without imposing regulations that inhibit religious freedom or are functionally ineffective."

In a move that is sure to spur controversy, Mr. Grassley recommended repealing or modifying I.R.S. rules that prohibit churches from endorsing political candidates.

Repeal has long been sought by groups on the Christian right that regard the prohibition as an intrusion on their freedom of speech. But the suggestion outraged groups that advocate separation of church and state.

The outcome of Mr. Grassley's investigation was disappointing to those who had thought that it might lead to some changes in the rules governing tax-exempt religious groups.

Marcus Owens, a lawyer who formerly headed the division of the I.R.S. that oversees tax-exempt groups, said of Senator Grassley: "He could have said we should change the law here and here. But passing this task onto another group that isn't really equipped to do it is probably going to result in a report that is going nowhere. So in a sense, it's like Grassley didn't want it to go anywhere."

Jill Gerber, a spokeswoman for Mr. Grassley, said he had learned from experience that introducing legislation was not necessarily more effective than seeking comment from organizations so they can better govern themselves.

The commission will be led by the Evangelical Council for Financial Accountability, an accrediting organization for churches that was born in 1979 out of an earlier Congressional inquiry into church financial scandals. The council has a reputation for financial integrity, but its work has been limited to evangelical Christian groups. The commission's mandate is to solicit comment from organizations of many faiths.

Commission members said in a news conference on Friday that they would examine thorny questions like whether religious groups should be required to file the annual financial reports known as Form 990s to the I.R.S., whether there should be restraints on compensation for clergy members and whether there should be limits on the tax-exempt housing allowances that clergy members now receive.

The investigation found that many of these ministries give housing allowances not only to the preachers who lead the ministries, but also to scores of relatives and friends who are classified as "ministers." Some ministers receive housing allowances for more than one home.

Dan Busby, president of the Evangelical Council for Financial Accountability, who will serve on the commission, said he believed the abuses were not widespread. He said that he agreed with Mr. Grassley that where there are problems, self-policing can make legislation or regulation unnecessary.

The inquiry began at the request of evangelical Christians who shared their alarm with Senator Grassley about how the six ministries appeared to be using donations from the faithful to buy airplanes, lavish homes and jewelry, and to run profit-making businesses for leaders and their family members.

All six are "prosperity gospel" ministries, which teach that believers will themselves become prosperous by donating generously to the ministry. The preachers flaunt their opulent lifestyles as evidence that their teaching is true.

The two ministries that responded fully to Mr. Grassley's investigation and indicated they had reformed their practices were Joyce Meyer Ministries and Benny Hinn Ministries.

The four ministries that provided incomplete or no information, according to the Finance Committee investigators, were Kenneth and Gloria Copeland of Kenneth Copeland Ministries; Randy and Paula White of Without Walls International Church; Creflo and Taffi Dollar of World Changers Church International; and Bishop Eddie L. Long of New Birth Missionary Baptist Church. (Bishop Long was recently sued by four young men who accuse him of luring them into sexual relationships. Bishop Long has denied the allegations.)

The commission will also examine whether to repeal or modify the current laws that prohibit houses of worship and other religious organizations from endorsing political candidates. In nearly every election year, a handful of churches are reported to the I.R.S. for partisan campaigning, but it has proved hard for the agency to police the prohibition.

Michael Batts, the founder of a C.P.A. firm in Orlando who will head the new commission, said, "There are religious leaders who believe that the current law prohibits their ability to exercise those freedoms in a manner they believe is constitutional."

But the Rev. Barry W. Lynn, executive director of Americans United for Separation of Church and State, said of this proposal, "It's a sign that this investigation has gone seriously off course."

Any original material on these pages is copyright © BishopAccountability.org 2004. Reproduce freely with attribution.