Pope Names Commission of Inquiry into Vatican Bank

Daily Herald

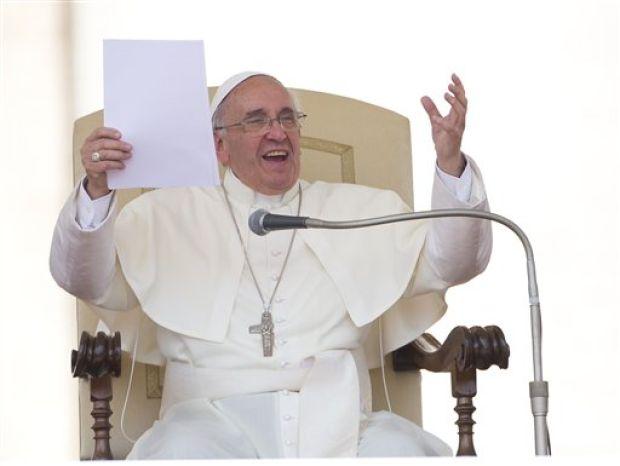

Pope Francis took a key step Wednesday toward reforming the troubled Vatican bank, naming a commission of inquiry to look into its activities amid a new money-laundering probe and continued questions about the very nature of the secretive financial institution. It was the second time in as many weeks that Francis has intervened to get information out of the Institute for Religious Works, or IOR. On June 15, he filled a key vacancy in the bank's governing structure, tapping a trusted prelate to be his eyes inside the bank. On Wednesday, he named a commission to investigate the bank's legal structure and activities "to allow for a better harmonization with the universal mission of the Apostolic See," according to the legal document that created it. Francis named five people to the commission, including two Americans: Monsignor Peter Wells, a top official in the Vatican secretariat of state, and Mary Ann Glendon, a Harvard law professor, former U.S. ambassador to the Holy See and current president of a pontifical academy. American cardinals were among the most vocal in demanding a wholesale reform of the Vatican bureaucracy _ and the Vatican bank _ in the meetings outlining the priorities for the new pope in the run-up to the March conclave that elected Francis. The demands were raised following revelations in leaked documents last year that told of dysfunction, petty turf wars and allegations of corruption in the Holy See's governance. Francis, who has made clear he has no patience for corruption and wants a "poor" church, has already named a separate commission of cardinals to advise him on the broader question of reforming the Vatican bureaucracy as a whole. The Vatican bank was founded in 1942 by Pope Pius XII to manage assets destined for religious or charitable works. Located in a tower just inside the gates of Vatican City, it also manages the pension system for the Vatican's thousands of employees. The bank commission's members have authority to gather documents, data and information about the bank's legal status and activities, even overriding normal secrecy rules to do so. Members can receive information from anyone in the Vatican bureaucracy as well as people who spontaneously volunteer information, and the commission can refer to outside advisers if necessary, according to the terms. The commission will report back to Francis _ presumably with both information and recommendations _ and then will be dissolved, the document states. No timeframe was given but the commission is to start working soon. The bank's daily management and activities continues unchanged. The announcement came as the Vatican faces a new embarrassment: Prosecutors in the southern city of Salerno have placed a Vatican official under investigation for alleged money-laundering stemming from cash in his IOR account. The Vatican spokesman, the Rev. Federico Lombardi, confirmed Wednesday that Monsignor Nunzio Scarano had been suspended temporarily from his position as an accountant in one of the Vatican's key finance offices, the Administration for the Patrimony of the Apostolic See. Scarano's attorney, Silverio Sica, told The Associated Press that the investigation stems from transactions Scarano made in 2009 in which he took 560,000 euros in cash out of his personal IOR bank account and carried it into Italy to help pay off a mortgage on his Salerno home. To deposit the money into an Italian bank account _ and to prevent family members from finding out he had such a large chunk of cash _ he asked 56 close friends to accept 10,000 euro apiece in cash in exchange for a check or money transfer in the same amount. Scarano was then able to deposit the amounts in his Italian account, Sica said in a telephone interview. The original money came into Sica's IOR account from donors who thought they were funding a home for the terminally ill in Salerno, Sica said. He said Scarano had given the names of the donors to prosecutors and insisted the origin of the money was clean, that the transactions didn't constitute money-laundering, and that he only took the money "temporarily" for his personal use. The home for terminally ill hasn't been built, though the property has been identified, Sica said. "He declares himself absolutely innocent," Sica said. There have long been questions about just what the IOR actually is and does _ questions which the commission presumably will try to iron out for Francis. Vatican officials have long insisted it's not even a bank, since it doesn't perform key banking activities like making loans. It does however take deposits, transfer money and invest for its clients, performing asset management services that in 2012 helped earn it 86.6 million euros in profit on 7.1 billion euros in total assets under management. Some cardinals have questioned if the Vatican needs such a financial institution and whether its activities are even in keeping with church teaching. In 2010, Italian financial police seized 23 million euros from an IOR account and Rome prosecutors placed the IOR's then-president and general director under investigation for alleged violations of Italy's anti-money laundering norms after they conducted a transaction from an IOR account at an Italian bank. The money was eventually unfrozen. The men technically remain under investigation but nearly three years on, haven't been charged. The Vatican bank's workings have long been shrouded in secrecy. Most famously, it was implicated in a scandal over the collapse of Italy's Banco Ambrosiano in the 1980s in one of Italy's largest fraud cases. Roberto Calvi, the head of Banco Ambrosiano, was found hanging from Blackfriars Bridge in London in 1982 in circumstances that remain mysterious. Banco Ambrosiano collapsed following the disappearance of $1.3 billion in loans the bank had made to several dummy companies in Latin America. The Vatican had provided letters of credit for the loans. While denying any wrongdoing, the Vatican bank agreed to pay $250 million to Ambrosiano's creditors.

|

.

Any original material on these pages is copyright © BishopAccountability.org 2004. Reproduce freely with attribution.