Vatican Bank Finds over 100 Suspicious Transactions, Official Says

By Tom Kington

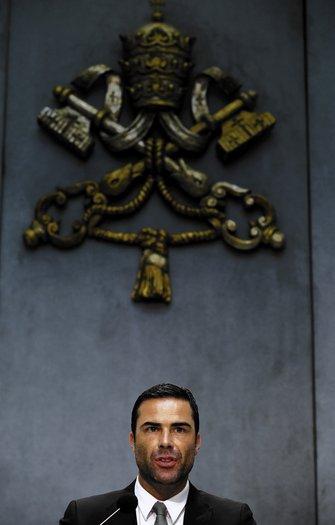

VATICAN CITY — The Vatican's bank has unearthed more than 100 suspicious payments this year after starting full-scale checks on its customers for the first time to crack down on money laundering, up from six last year, said an official knowledgeable about the cleanup effort. The official, who requested anonymity because he was not authorized to discuss the inquiry publicly, spoke after the Vatican said Monday that it had been given a positive progress report by Moneyval, the Council of Europe money-laundering monitor, after a middling grade in a full evaluation last year. The new report, which was signed off Monday and will be formally released by Moneyval on Thursday, gives an assessment but no grades. Rene Bruelhart, the Swiss banking expert serving as director of the bank's new oversight body, acknowledged last week that "there has been a very significant jump in suspicious transaction reports in 2013." Bruelhart was appointed last year as part of a drive by former Pope Benedict XVIand his successor, Pope Francis, to reform the scandal-dogged institution. Sporting well-groomed stubble and slick suits and dubbed the "James Bond" of the Vatican by the Italian media — much to his embarrassment — Bruelhart appears a fish out of water at the Holy See, where he keeps a room at the residence that also houses Francis. But after being drafted to shine some light on the Vatican's 18,900 bank customers, Bruelhart said he now has a firm grip on his task and believes exposing questionable accounts is part of the cleanup effort. "Understanding where the vulnerabilities are is of key importance and takes time, but that is what we have done, with the aim of building an early-warning system," he said. As it roots out suspicious payments, the bank is also asking about 1,000 account holders to take their business elsewhere, said a Vatican source who requested anonymity because he was not authorized to speak about the topic. Those customers do not fit the bank's tightened-up customer profile of priests, religious organizations, Vatican staff and Holy See-accredited diplomats. That means no more accounts for the Italian nobles and the well-heeled who wangled access over the years as a status symbol and a handy shelter from the Italian tax man. "There is an ethical concern about tax evasion, but there is also an idea that the bank should just serve the Holy See," said another Vatican source who also requested anonymity because he was not authorized to discuss the situation publicly. Set up in 1942 to support religious works and now holding $7 billion in assets, the Institute for Religious Works has been no stranger to scandal since a former governor, American Archbishop Paul C. Marcinkus, was indicted in 1982 after the bank was implicated in the collapse of Italy's Banco Ambrosiano, in which it was a stakeholder. Roberto Calvi, then chairman of Banco Ambrosiano, was found hanged under London's Blackfriars Bridge under suspicious circumstances that year. Until last year, the Vatican refused requests for information from Italian magistrates investigating other cases of suspected criminal activity. The shift came after Benedict decided to clean house, creating an oversight body, the Financial Information Authority, which started work in April 2011. The authority brought in Bruelhart after his efforts to reform Lichtenstein's banking system and has put him to work alongside the Vatican bank's new chairman, Ernst von Freyberg of Germany, appointed by Benedict in February. This year the bank published its balance sheet for the first time. One incentive to reform was the increasing reluctance of other banks to do business with the Vatican bank. In January, visitors to the Vatican's museum were temporarily forced to pay in cash when the Bank of Italy blocked its credit card payment system. The cleanup has not been clear sailing. In June, Msgr. Nunzio Scarano, an account holder and staffer at a separate Vatican department handling investments, was arrested on suspicion of trying to smuggle the equivalent of $26 million into Italy from Switzerland on a private jet as part of a tax scam. The bank's director general, Paolo Cipriani, and his deputy, Massimo Tulli — both reportedly close to Scarano — resigned. An internal report on Scarano's bank account, completed since his arrest, is "covered in red flags," said the first Vatican source. "Scarano's transactions totaled 7 million euros [$9.6 million] over 10 years, and the sort of transactions that would have been red-flagged are large sums entering the account one day, followed by many smaller payments equaling the total being paid out the next day," he said. Since May, 25 experts from consulting firm Promontory have set up shop at the bank's headquarters to speed up checks on accounts. About 10,000 have been analyzed. Apart from Scarano, whose account has been frozen, officials will not reveal how many accounts have been blocked. "I cannot exclude there will be other cases," Bruelhart said. Francis, who has called for a "poor" church and has even raised the prospect of closing the bank, probably will be watching impatiently. But recent changes he has made suggest he thinks reform is possible. In November he appointed his personal secretary, Msgr. Alfred Xuereb, to supervise a commission he had set up to oversee the bank's activities. A papal document issued in August, known as a motu proprio, extended the Financial Information Authority's powers and allowed it to scrutinize activity at the Vatican investment department, where it has emerged that 23 customers were offered bank accounts even though the department lacks the status of a bank. Those accounts will be shut down, said the second Vatican source. Cardinal Attilio Nicora, president of the authority and Bruelhart's superior, meanwhile has stepped down from a panel of cardinals set up to monitor the Vatican bank; Moneyval had criticized his dual role as a conflict of interest. The motu proprio also changes the authority's hiring policy, paving the way for a lay financial expert, not necessarily a cardinal, to succeed Nicora. "Developments in the last few months have shown there is a very strong commitment at the Holy See to introduce a well-functioning and sustainable system to fight financial crime," Bruelhart said. "These efforts will continue."

|

.

Any original material on these pages is copyright © BishopAccountability.org 2004. Reproduce freely with attribution.