The Australian Salvation Army's Finances OR: Melding Church and STATE

Lewisblayse.net

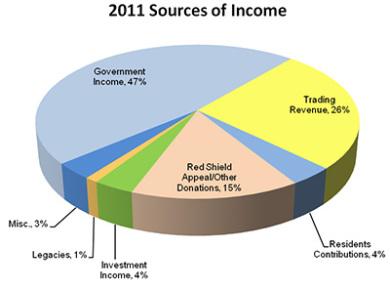

The Salvation Army in Australia receives nearly half of its income from the taxpayer. In some countries this would raise concerns about state-supported religion. It would be of further concern to such people that the Salvation Army has not only a special status of being tax-free and not required to give any information on its finances or spending, it is also exempted from other laws, such as discrimination in employment and adherence to the minimum wage laws applicable to general businesses, in certain cases. The organisation has always courted Australian politicians; especially Prime Ministers (see photos below). This is because the most money can be obtained from the Federal, rather than the State, governments. A past “General” (i.e., sort of Pope) of the Salvation Army was an Australian, Eva Burrows. When she retired, the Prime Minister at the time, Bob Hawke, attended her “welcome home” to Australia party. She noted that, after a federal government “tax summit” she addressed, the Hawke government “announced that charities [like hers] would be free from the consumer tax and so forth.” “We were quite friendly…. I may not have liked other aspects of his life [such as being a drunk and womanizer] but, nevertheless, there was a style in his leadership that I’d say was similar to mine.” A 2005 article by Stephen Mayne, in “Crikey” magazine, raises some interesting points about the Salvation Army and taxpayer funds. Mayne refers to the “windfall gains from sale of the Salvation Army’s Retirement Villages. These were largely set up in the 1950s and 1960s when the Federal Government paid one third of the cost, the relevant State Government paid one third, and one third was paid by The Salvation Army, who then owned and operated the institutions.” This appeared to be a typical example of the Salvation Army helping poor, old people. Not so, in reality. As Mayne again notes, “Many of these villages are on prime real estate which The Salvation Army has held free of rates and taxes….The Salvation Army sold 14 of these properties to Macquarie Bank for an estimated $120 million earlier in 2005 and is examining further sales, all of which will be completely tax free.” He claims that $40 million should be returned to the federal government and the same to the State governments. [Some of the old Children’s Homes sites have similarly been turned into lucrative real estate investments.] Mayne gives another troubling example, which continues, in some form, even today. When the federal government established the “Job Network” program to lower unemployment, it involved paying private contractors to assist the unemployed to gain skills and help with job searches. Under the scheme, the Salvation Army “receives about $250 million a year for its efforts, some of which disaffected former staff believe is squandered on large salaries, entertainment and other benefits for senior management. However, being a church, the Salvation Army is not accountable to anyone in relation to its fiscal affairs and competes with private operators in the Job Network who must pay full tax.” “Furthermore, because of its non-taxable status, its employees are able to benefit from a ‘salary packaging’ scheme whereby up to 30% of their income is tax free. This costs the Australian taxpayer millions of dollars every year. It also gives the Salvation Army a huge advantage over its competitors,” Mayne reports. The Australian Royal Commission into Institutional Response to Child Sexual Abuse is due to hold its next hearings, beginning 28th January, on selected Salvation Army Children’s Homes. What it will not cover is the fact that government and private funds provided a profit base from this activity as the children were badly fed, accommodated and clothed. It will not, also, consider the hundreds of millions of dollars the Salvation Army has made from the, donated, land on which these Homes were built. It will almost certainly not consider the profits the organisation made from child slave labour. Government funding is more than triple its major fund-raiser in Australia, the Red Shield Appeal, and private and corporate donations combined. Put in a simplified way, for comparison with other countries, the Australian Salvation Army received more government money than did the whole of the U.S. organisation (Australian population 23 million – U.S. population 320 million), in recent years.

|

.

Any original material on these pages is copyright © BishopAccountability.org 2004. Reproduce freely with attribution.