|

Pope Francis Names New Leadership for Vatican Bank

By Jim Yardley

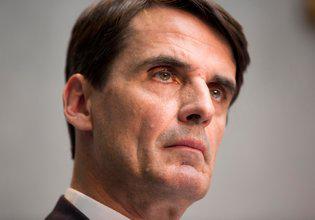

VATICAN CITY — Pope Francis continued his efforts to modernize and reorganize the Vatican finances on Wednesday, by appointing a new leadership for the scandal-tainted Vatican Bank, streamlining other operations and signaling future changes to the church’s global media operations. “Our ambition is to become something of a model in financial management rather than a cause for occasional scandal,” Cardinal George Pell, the pope’s recently appointed prefect on economic affairs, said at a news conference on Wednesday. The most prominent move, rumored for weeks, was the appointment of Jean-Baptiste de Franssu as the new president of the Vatican Bank, officially known as the Institute of Religious Works, or I.O.R. Mr. de Franssu, a Frenchman who was formerly head of European operations for the investment management company Invesco Ltd., had been serving on an economic advisory council that Francis created in March. He replaces Ernst von Freyberg, a German industrialist appointed last year. Cleaning up the Vatican’s murky finances has been a top priority for Francis, especially after many of the cardinals who elected him as pope in March 2013 spoke openly about their displeasure with the Vatican’s financial operations. In recent years, the Vatican Bank has been under growing pressure to comply with international practices to fight money laundering and meet other global norms. In 2010, Italian prosecutors temporarily seized $30 million from two accounts at the bank as part of a financial investigation. It was Francis’s predecessor, Pope Benedict XVI, who appointed Mr. von Freyberg to begin cleaning up the bank. Joined by outside consultants, his team was given the task of introducing greater transparency in bank practices while also examining about 18,000 accounts at the Vatican Bank for possible illegal activity. His team published the bank’s first ever annual report and instituted protocols to prevent money laundering. And more than 3,000 accounts have been closed, most due to inactivity or small balances, though nearly 400 were closed after bank officials decided to narrow eligible customers to people with direct ties to the church. “Today, I.O.R. is in good shape, also financially,” Mr. von Freyberg said at the news conference on Wednesday. The bank’s legacy of past mismanagement was evident in an annual report released on Tuesday. It showed that profits had fallen sharply because of the declining price of gold as well as write-downs on bad loans issued before 2013. One priority has been to tighten internal bank controls to prevent powerful church officials from handing out loans with limited scrutiny. In recent weeks, European news media have reported on an unconfirmed investigation into a bank loan of 15 million euros ($20.4 million) to a Catholic filmmaker that was approved in 2012 by the Vatican’s former second-in-command, Cardinal Tarcisio Bertone. Such a write-down was listed in Tuesday’s financial reports, though without specific mention of Cardinal Bertone. On Wednesday, Cardinal Pell praised Mr. von Freyberg’s role at the Vatican Bank, noting that he had overseen the first phase of reforms while working part-time, splitting his weeks between Germany and Rome. He said the position now demanded a full-time occupant. At the same time, many analysts say, the restructuring will limit the authority of the bank and other existing Vatican financial institutions over some assets and investments while placing more power in the new Secretariat of the Economy, which was created by Francis and is now led by Cardinal Pell. “For the I.O.R., it’s an epochal change,” said Paolo Rodari, an expert on the Vatican at the Italian daily newspaper La Repubblica. “It will become a mere retail bank, as many cardinals during the conclave had called for. But this move allows the Vatican to keep having a bank that distributes money to all its missions all over the world.” Analysts say that Cardinal Pell, an Australian, is emerging as a major power broker in Francis’s restructuring of the Vatican bureaucracy, while Italian prelates who were once dominant in economic affairs have seen their clout diminished. Cardinal Pell also announced the formation of a committee to propose changes to the Vatican’s media operation, which will be led by Christopher F. Patten, the chancellor of Oxford University. The cardinal said the Vatican media division, which employs a large staff of translators and journalists, especially on radio, needed to be modernized, and he predicted future cost savings through attrition and restructuring.

|

.

Any original material on these pages is copyright © BishopAccountability.org 2004. Reproduce freely with attribution.