|

Render Unto Caesar?

By Jennifer Haselberger

Canonical Consultation

January 10, 2015

http://canonicalconsultation.com/blog.html

I was surprised, and honored, to receive an email yesterday morning from a former professor of mine who says that she reads this blog and hopes that I will address the question of donations to parishes in the Archdiocese of Saint Paul and Minneapolis. Specifically, she wrote:

'I am troubled regarding contributions to my local parish. Because of the percentage that is automatically taken by the archdiocese, I don't feel comfortable contributing, though I am sad not to be able to support my local parish.

Reputable nonprofits with which I am familiar will allow you to stipulate restrictions on your donations. For example, the ALS ice-bucket challenge allowed you to stipulate that your donation was not to be used to support the embryonic stem cell research that the ALS Association funds. Why are we not allowed to restrict our contributions to our local parishes?'

The short answer is, you are. Canon law is very clear that donations given for a specific purpose may only be used for that purpose:

Canon 1267, 3- Offerings given by the faithful for a specified purpose may be used only for that purpose.

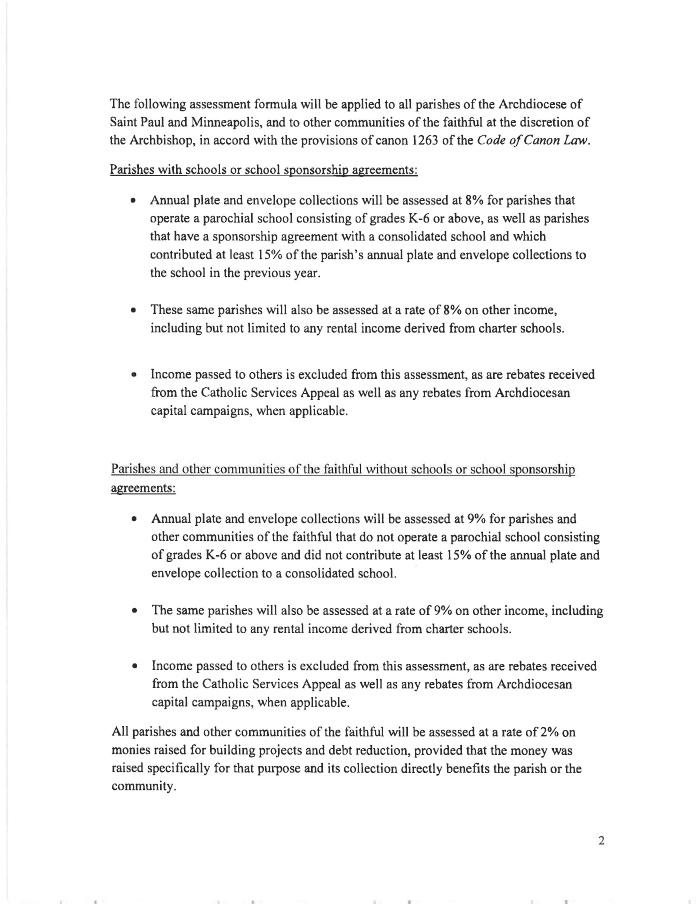

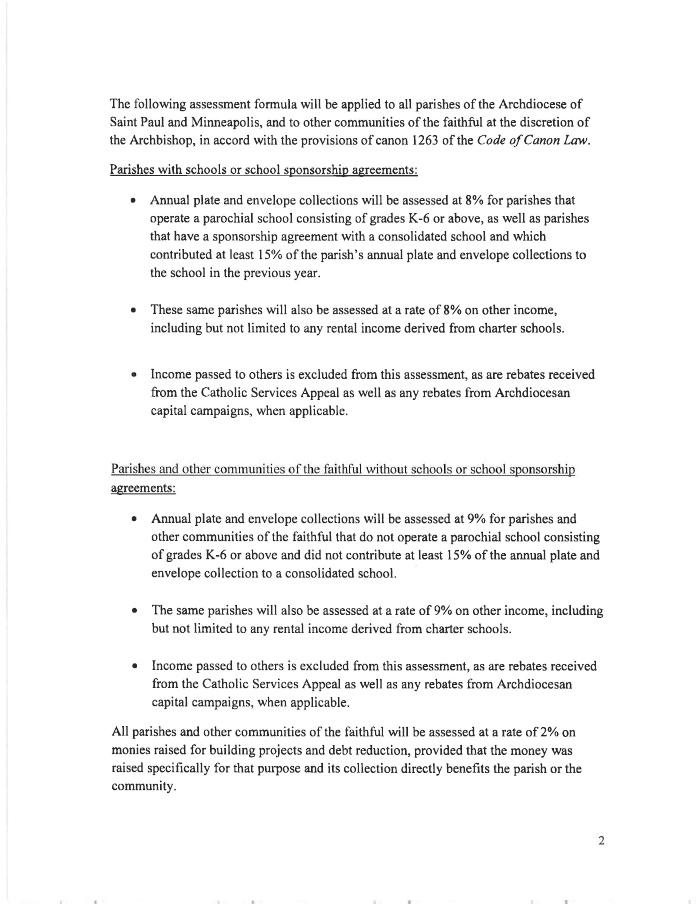

However, if you make this offering by means of the weekly collection plate or collection envelopes, the parish will have to count that donation when figuring the amount it must pay to the Archdiocese, per the assessment formula (see the Clergy Bulletin posted below). Your dollars may not be used to pay the assessment per se, but since your contribution will be tabulated along with other monies received, the effect will be the same.

But, there is nothing that says that you must contribute in this way. Instead, it is possible to send cash or a check to the parish office with a letter noting that your contribution is to be used exclusively for a particular ministry or purpose, and not towards the parish assessment or any other tax levied by the Archdiocese. Or, you can contribute to specific fundraising efforts, noting that a lesser tax (2%) is applied to contributions to building projects or debt reduction funds.

Better yet, there is nothing to prevent you from supporting your parish by paying third party vendors or service providers directly, or providing required goods. You see this often in rural parishes where, for instance, a family might pay for the supply of heating oil for the winter months. You should speak with your pastor or parish business administrator regarding how best to make such a contribution, but I would be surprised if contributions towards heating or electric bills, snow plowing, cable/phone/internet services, software licenses, postage, liturgical wine and communion wafers, flowers for the church, printing costs, and for contracted services such as musicians and sign language interpreters are refused. You may also find that some pastors (especially those of a certain age) have become incredibly adept at receiving donations that are not counted towards the Archdiocesan assessment.

If you choose to contribute in this way, you should speak with your accountant prior to claiming such contributions as tax deductible. I would also suggest avoiding contributions to things like insurance or pension funds, which are administered by the Archdiocese. Also note that the Archdiocese intends to tax 'other income' received by parishes.

However you choose to donate, pastors of parishes, along with business administrators and finance council members, are obliged to ensure that the stipulations of donors are honored (canon 1284, 3). If you contribute monies for a specific purpose, you should expect to receive confirmation that your contribution was used accordingly.

The same solemn responsibility binds the diocesan bishop, who is given the authority to resolve any questions regarding the application of donations. However, a donor who feels his or her intention was disregarded does have the opportunity to challenge the decision of the bishop through hierarchical recourse.

[N.B. Parishes in the Archdiocese of Saint Paul and Minneapolis, and elsewhere, are audited. Some are audited yearly because of debt repayments plans or loan financing requirements. Otherwise the frequency of audits, as well as whether a certified audit is conducted as opposed to a uncertified review with accompanying management letter, is based on the size of the parish's annual budget. All parishes should undergo a full audit when there is a change in pastor.]

|

|

|

|