Archdiocese Vastly Undervalued Its Assets, Creditors Claim

By Jean Hopfensperger

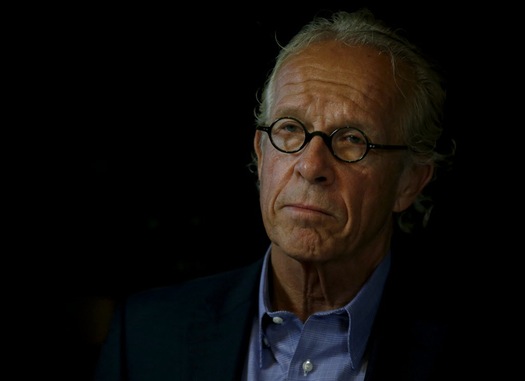

The Archdiocese of St. Paul and Minneapolis is shielding $1.7 billion in assets from bankruptcy court in order to keep them out of reach of clergy abuse victim claims, according to a motion filed in U.S. Bankruptcy Court by the abuse survivors committee. The motion, filed Monday, argues that the archdiocese has not acknowledged its financial stake in its parishes, cemeteries, the Catholic Community Foundation, the Catholic Finance Corporation and more. It asks the court to consolidate the archdiocese assets as it moves toward a victims’ settlement. “It’s a serious and sinister scheme to hide and conceal their true net worth,” St. Paul attorney Jeff Anderson said at a news conference Tuesday. Archbishop Bernard Hebda said that “the archdiocese has disclosed all of its assets” and that it has cooperated fully with the bankruptcy court. Hebda said that the archdiocese has been working “to marshal and maximize our assets” and that it has followed all of the rules set forth by the court. This week it will file its reorganization plan, which will include proposed compensation for victims. The archdiocese filed bankruptcy in January 2015 as it faced a barrage of abuse claims following the passage of a new law that gave older abuse claims their day in court. The archdiocese reported a net worth of $45 million, which the motion claims is a fraction of its true worth.

Attorneys for abuse survivors argue that the true worth should reflect about $1.4 billion in parish assets, $270 million from the Catholic Community Foundation and $30 million from the Catholic Finance Corporation. As abuse claims mounted, the archdiocese shifted money into related nonprofit organizations, the motion said. Anderson displayed documents indicating that during that period, the Catholic Finance Corporation and the Catholic Services Appeal Foundation were spun off from the archdiocese. Anderson also showed a 2014 video deposition of the archdiocese’s former vicar general, the Rev. Kevin McDonough, in which McDonough acknowledged that the Catholic Community Foundation was created in part to protect archdiocese donations from abuse liability. In a series of photos, Anderson showed changes in archdiocese signs that he said were designed to conceal their ties to the church. The sign outside St. Mary’s Catholic Cemetery in south Minneapolis, for example, had been painted to cover the words “Archdiocese of St. Paul and Minneapolis.” “It’s a scam. It’s a shame. It’s a lot of money,” said Anderson. It’s not unusual for dioceses and archdioceses to try to shield assets from victims’ claims in bankruptcy court, said Mike Finnegan, an attorney in Anderson’s firm, which has been involved in a dozen such bankruptcies. How they do it, however, has differed. In the Milwaukee archdiocese’s bankruptcy, for example, much of the focus was on $60 million tied up in cemetery funds. In the Twin Cities, the elephant in the room is the archdiocese’s 187 parishes. They were incorporated independently, but they are under the control of the archbishop here — as they are across the country, said Charles Zech, a professor of church finance at Villanova University in Pennsylvania. Zech said the motion made a compelling case for including the parishes in archdiocese assets, because “everyone knows … archdioceses control every major financial aspect of the parishes. “This is going to slow things down,” Zech said. The case has been in mediation since the bankruptcy filing, and discussions have been confidential. But with the court filing, Anderson acknowledged that mediation has hit the rocks. He said the “transparency” he had hoped for never happened. “They have claimed they have such limited assets that they can’t cover even 10 percent of these claims,” said Anderson. Hebda said that the archdiocese is “carefully reviewing the motion, and will count on the court to properly evaluate it.” “The bankruptcy process is complex and difficult,” Hebda said. The institutions under scrutiny in the proposal likely would have a different perspective than one laid out in the motion, he added. “We welcome the scrutiny of the court, and all others involved,” Hebda said. “We believe it will show our commitment to a fair, just and timely resolution of all the claims made against us, especially of those who have been hurt by people in the church.”

|

.

Any original material on these pages is copyright © BishopAccountability.org 2004. Reproduce freely with attribution.