|

St. Joseph Bankruptcy: Diocese Failed to Make Contributions to Employees Pension Fund for Years

GoLocalProv

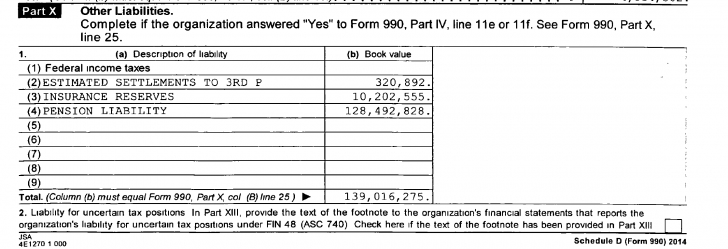

The pension fund of St. Joseph Health Services was underfunded by the Diocese of Providence for many years prior to the sale of the hospital to CharterCARE in 2014, GoLocalProv has learned. The Diocese of Providence failed to make proper contributions - and retirees were never told of the shortfalls. While records are incomplete, it is clear that between 2008 and time of the sale of the hospital in 2014, the Diocese repeatedly underfunded retirement payments or made no payment, according to Stephen Del Sesto, the court-appointed receiver. It is unclear how many years before 2008 the failure to make payments and partial payments goes back. Repeated efforts to reach the Diocese for comment have gone unanswered. The bankruptcy of the pension fund impacts 2,800 and is the largest failure in Rhode Island history. The pension fund has a deficit of more than $160 million. "The Catholic Church and Diocese of Providence should be ashamed of themselves," said former Rhode Island Attorney General Arlene Violet in an interview with GoLocal Sunday night. When St. Joseph was sold, the hospital was in financial free fall. According to financial documents of St. Joseph, in 2013, it began the year with nearly a $50 million deficit and ended the year with a $79.4 million deficit. But, by 2014 as the sale was being executed, the shortfall of the St. Joseph company was ballooning — the deficit between assets and liabilities grew from $79.4 million to more than $132 million. In 2014, IRS documents secured by GoLocalProv unveiled that the fund was orphaned only with the approval of Attorney General Peter Kilmartin. The IRS document reads, “In June 2014 substantially all assets of St. Joseph Health Services of Rhode Island were transferred to Prospect CharterCARE LLC under a plan approved by the Rhode Island Attorney General [Peter Kilmartin] and under the supervision of the Rhode Island Department of Health. The non-profit corporation remains in existence to allow for the orderly wind down of the affairs of the hospital, principally the collection of revenue and other third party payors for the medical services previously provided and payment obligations for the pension liability of the hospital.” That same document reported that the “orphaned” entity had total liabilities of $139,016,275 or which $128,492,828 were the pension liability. The other liabilities were $320,892 for estimated settlement payments to third parties and insurance reserves of $10,202,555. St. Joseph was being stripped for parts and the “old company” was being left with all the problems including its employees' pension shortfall. While the hospital was in financial demise, the pension fund was even more financially frayed. The sale of the hospital to CharterCare gave the healthcare element stability, the transaction left the pension fund as an orphan company without resources. The year before the sale, the pension had a deficit of $76.4 million according to St. Joseph Health Services federal IRS filings. “It is clear that the pension fund was underfunded,” said Del Sesto. “This fund presently has the resources to last maybe ten years, but it needs to support retirees for 40 to 45 years." Who was in charge? The hospital was under the oversight of the Diocese of Providence until 2008 when it merged with Roger Williams Medical Center - now Roger Williams Hospital. That combined entity headed by Roger Williams Medical Center oversaw the hospital and the fund managed the assets until the hospital was sold to CharterCARE in 2014, but in that merger, Kilmartin approved a one-time $14 million payment to the fund, but then allowed the nonprofit that managed the pension fund to be “orphaned” and left behind. Since the St. Joseph pension fund was cast aside, the overseeing non-profit was managed by a board comprised of three Board members who are Daniel J. Ryan, President of the Board; Reverend Timothy Reilly of the Diocese of Providence; and Dr. Joseph Mazza, a cardiologist at Roger Williams Hospital, according to the most available 990 forms. Efforts to reach Chair of the Board Ryan have been unsuccessful. The one-time payment made the fund “90 percent funded” at that time, but not for payments for the length of the pension funds obligations. Retirees learned of the underfunding when GoLocal broke the first story on the pension fund's bankruptcy on August 18.

|

.

Any original material on these pages is copyright © BishopAccountability.org 2004. Reproduce freely with attribution.