More of a Montana Catholic Diocese's Assets Should Be on the Table for Abuse Victims

By Clair Johnson

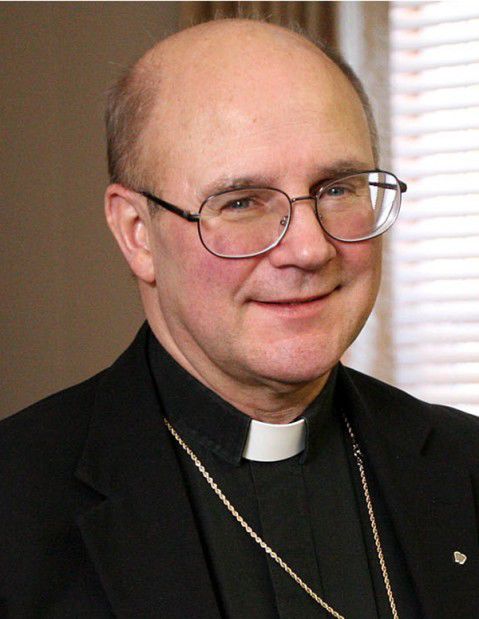

A Committee of Unsecured Creditors in the bankruptcy of the Roman Catholic Diocese of Great Falls-Billings is suing the church, alleging that more than $70 million in real property and other assets are part of the church’s estate and should be available for creditors and survivors of sex abuse by church officials. The adversarial complaint, filed late Monday in U.S. Bankruptcy Court, said getting the disputed assets issue resolved “is critical” to the church’s estate because it will “determine the magnitude of distributions to its creditors, including survivors of the childhood sex abuse enabled by (the diocese) or whether (the diocese) can continue to avoid being held accountable to the survivors.” Attorney James Stang, of Los Angeles, California, who represents the unsecured creditors committee, said on Wednesday the committee's goal is to reach a negotiated settlement and that the complaint is "part of the process." The committee represents eight sex abuse survivors, Stang said. Stang, who has represented unsecured creditors in 11 other Catholic church bankruptcies since 2004, including the Diocese of Helena's bankruptcy, said every case has resulted in a negotiated resolution. Bishop Michael Warfel on Wednesday called the committee’s lawsuit “a most unfortunate and unnecessary distraction” in settling the bankruptcy. The suit alleges the diocese contends that assets to which it holds legal title are held in trust for its parishes, and as a result, are not part of its bankruptcy estate and are unavailable for creditors, including the survivors of sex abuse. The diocese, the complaint continued, also has “previously acknowledged that the Parishes are not separate legal persons or entities but are part of (the diocese) akin to divisions of a for-profit corporation. Accordingly, they may not hold title to property or be the beneficiaries of a trust.” The parishes named in the complaint include: Holy Rosary, in Billings. St. Barnard, in Billings. St. Patrick Co-Cathedral, in Billings. St. Pius X, in Billings. Our Lady of Lourdes, in Great Falls. Holy Family, in Great Falls. Holy Spirit, in Great Falls. Corpus Christi, in Great Falls. St. Joseph, in Plentywood. St. Mary, in Livingston. St. John the Evangelist Church, in Baker. St. Bernard Church, in Charlie Creek. St. Theresa, in Lambert. St. Anthony Church, in Culbertson. The committee alleges that the assessed value of the disputed real property is more than $70 million, based on what the diocese identified in a schedule of assets filed in the bankruptcy case. The diocese filed for bankruptcy reorganization on March 31, saying it was the best way to meet its obligations to all victims with sex abuse claims against the church and to continue its ministry. The diocese has two sexual abuse lawsuits filed against it and is defending the civil cases in court. In addition, there are at least 72 people with abuse claims against the diocese. In a news release on Wednesday, Darren Eultgen, chancellor for the diocese, said the church is aware of the adversarial lawsuit and will be filing a response challenging the claims that parish savings and real property belong to the diocese. The Diocese of Great Falls-Billings “strongly disagrees with this claim and insists the Diocese holds these assets in trust. We also believe that the 14 affected parishes disagree,” Eultgen said. Bishop Warfel said the diocese will “fully contest” the committee’s assertions and believes that the 14 parishes will hire lawyers and contest the claims. “This is a most unfortunate and unnecessary distraction from the tasks at hand in the bankruptcy, in creating and ultimately distributing a fair and just settlement to the abuse victim,” Warfel said. “The diocese will continue in its commitment and efforts to reach a fair resolution of these claims in the bankruptcy,” Warfel said. Mediation with parties in the case so far has not led to a settlement. A two-day negotiation session in Reno, Nev., on Sept. 6 and 7 ended in an impasse, court records said. The diocese is the second Montana diocese and was the 15th U.S. diocese to file for bankruptcy to settle abuse claims. The Diocese of Helena settled its bankruptcy in 2015 with a $20 million payment plan. The settlement addressed more than 360 abuse claims and created a trust fund for victims who come forward in the future.

|

.

Any original material on these pages is copyright © BishopAccountability.org 2004. Reproduce freely with attribution.