|

Why we need to tax the ‘costly joke’ of religion

By Ian Henschke

Royal Commissions have been in the news lately. And it’s been a sad and sorry time. Last month was the National Apology following the findings of the inquiry into Institutional Responses to Child Sex Abuse. That happened while the top end of town was reeling from revelations from the investigation into Misconduct in the Banking, Superannuation and Financial Services Industry. Now we’ve got another starting in Adelaide looking into Aged Care Quality and Safety. Royal commissions focus the minds of the public and the parliament. They also have repercussions. Look at the fallout from the one into banking and finance. The businesses involved have been hit with fines and remediation costs totalling more than a billion dollars. They have to give back money. Heads have rolled and there’s talk of criminal charges.

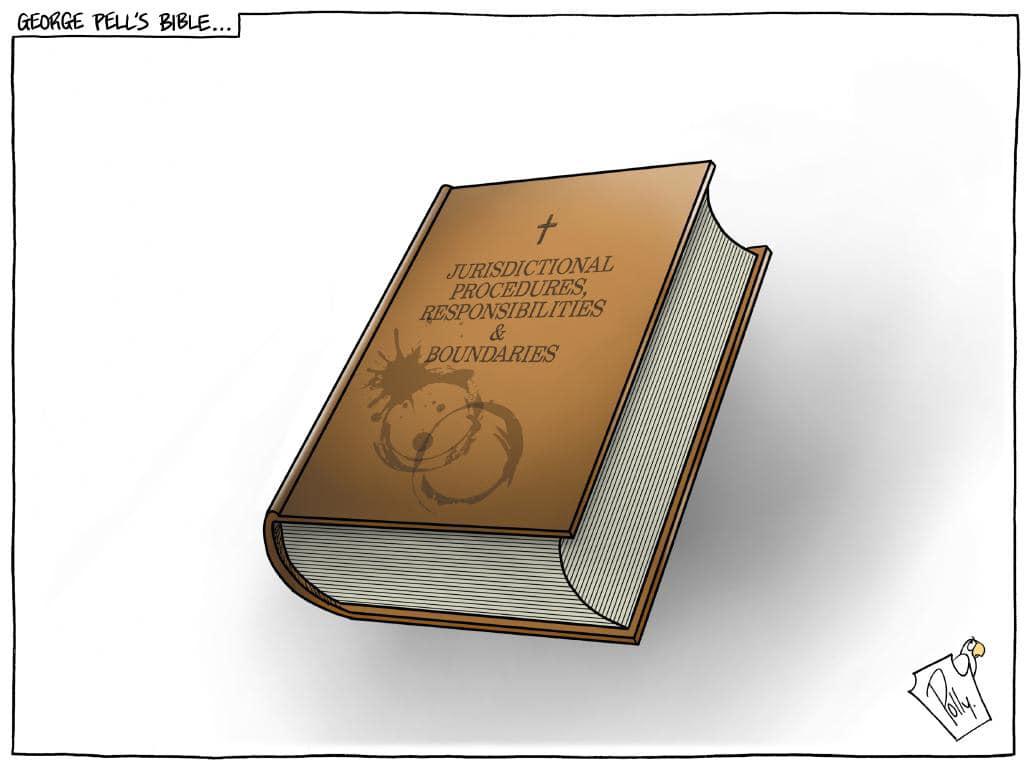

The days of slogans like “Who can you bank on? Who can you trust?” have gone forever. The damage is not just to reputations. So why is it we have a much greater reward, tax-free status, for organisations condemned for their depraved deeds uncovered in the Royal Commission into Child Sex Abuse? At the apology, Bill Shorten said the true test for the parliament would be “what happens next”. One of the spectators yelled “stop funding them”. That would also mean removing the tax-free status from all the religious institutions who have broken and bent the law. If it were a bikie gang abusing children and moving members of their brotherhood from state to state to escape prosecution it would be outlawed. There would be an outcry if they were able to continue to operate, let alone be given tax-free status and subsidies. This magazine features a story today about a paedophile Jesuit, Victor Higgs. He abused students at St Ignatius in Athelstone in the late 1960s and early 1970s. One boy told his mother. He says she told the school and, later, it moved Higgs to St Ignatius, Sydney. He continued abusing boys for another decade. The schools where he taught have a string of judges and politicians who are “old boys”. They include Bill Shorten, Tony Abbott, and Barnaby Joyce. Barnaby remembers Higgs as a “creep” who tried to molest him and his fellow boarders. Will these leaders dare to question the tax-free system that educated them while it covered up abuse and allowed it to fester? And what about the calibre of church leaders? The latest fall from grace is Philip Wilson. The former president of the Australian Catholic Bishops’ Conference was sentenced to a year imprisonment for concealing child sex abuse. Meanwhile, Cardinal George Pell awaits trial. The Anglicans have Archbishop Ian George, who resigned in 2004. He told the Royal Commission he was “truly sorry my leadership failed” the survivors of abuse. And there’s Archbishop Peter Hollingworth. He resigned as Australia’s Governor-General in 2003 after mishandling allegations of child sex abuse against a paedophile priest who pleaded guilty to 28 charges involving five boys. Greg O’Kelly, the present Catholic Archbishop who replaced Philip Wilson, admitted in July that when he was headmaster at St Ignatius College in the 1990s he didn’t believe a boy’s “version of the ordeal” he’d had at the hands of Stephen Hamra. That teacher moved on and abused again. O’Kelly wrote to the victim saying “it is with sorrow that I admit that now”. Have these organisations who ignored, believed and protected abusers lost the right to a tax-free ride? A poll two years ago found almost two thirds of Australians think religions should pay tax. But when Nick Xenophon tackled the Church of Scientology in the Senate it failed. Was it fear the mainstream churches would be next? Religion is big business in Australia. It runs schools, hospitals and aged care homes. There are wineries and breakfast food companies. The churches own billions of dollars in real estate. It’s the same in Canada. But religion’s tax-free status is now being questioned as that country struggles to balance its budget. What sort of debate will we have? I expect personal attacks and outraged letters for daring to question the status quo. But we live in 2018 not 1618 so I can’t be burnt at the stake. In Melbourne in 2010 Max Wallace addressed the Global Atheist Convention. He brought the house down with his definition of religion as “an unregulated onshore tax haven subsidised by taxpayers to pursue the supernatural”. It’s a joke and a very costly one.

|

.

Any original material on these pages is copyright © BishopAccountability.org 2004. Reproduce freely with attribution.